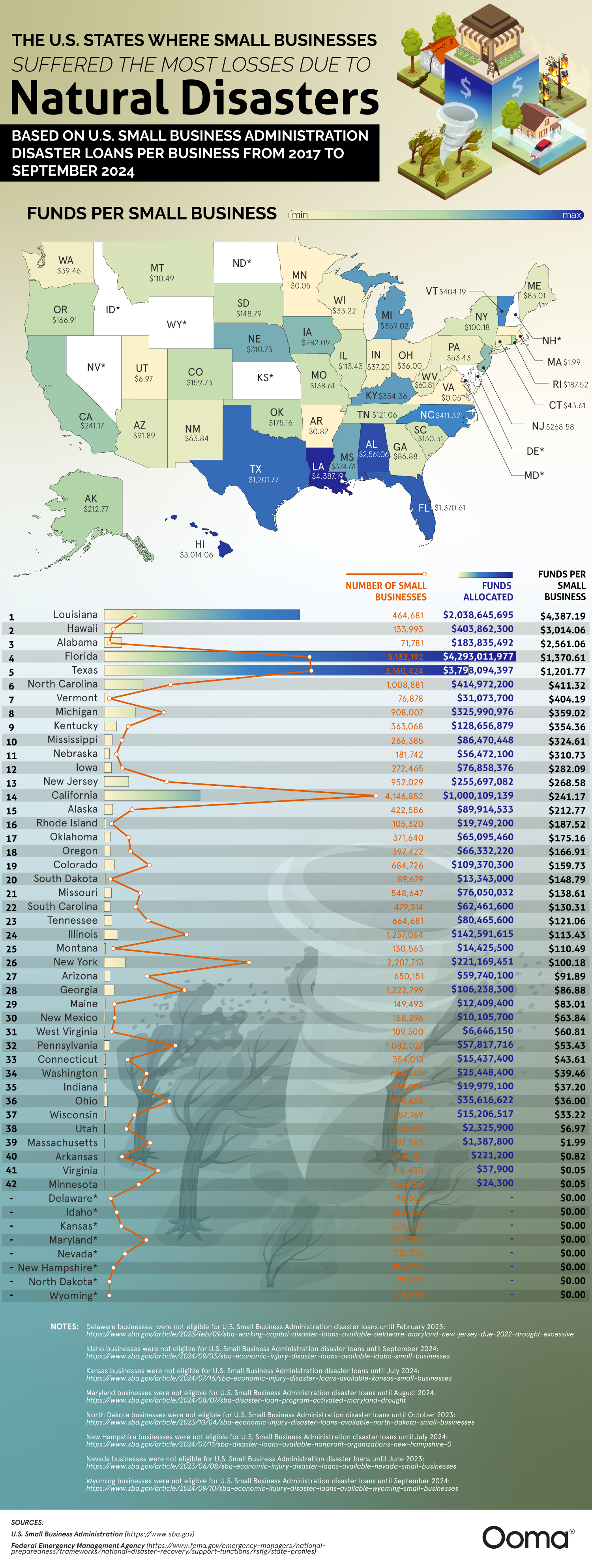

The U.S. states where small businesses suffered the most losses due to natural disasters

Based on U.S. Small Business Administration Disaster Loans Per Business From 2017 to September 2024

In the United States, small businesses are frequently among the victims of significant natural disasters such as storms, floods or wildfires. These events don’t just damage buildings or equipment—they can devastate the dreams and livelihoods of small business owners. Many of these businesses, especially in states that see frequent natural disasters, must rely on small business disaster funding to get back on their feet. That’s where the U.S. Small Business Administration steps in with disaster loans.

With Hurricane season still looming, the Ooma team decided to look at natural disaster funding by state. With the following data compiled from the Federal Emergency Management Agency (FEMA) and the SBA, we can see the U.S. states where small businesses have received the most financial aid for natural disaster relief.

How do natural disasters affect small businesses?

Natural disasters don’t just cause physical damage to buildings and equipment—they also disrupt day-to-day operations and can lead to long-term financial struggles. Small businesses, which often have fewer resources and smaller safety nets than large corporations, face unique challenges when recovering from disasters.

One of the most immediate effects of natural disasters is the physical damage to the business’ property. Floods, hurricanes, wildfires, tornados and landslides can destroy buildings, equipment and inventory. According to the 2021 Small Business Credit Survey (SBCS), 1 in 10 businesses suffered losses from a natural disaster in 2021. The National Centers for Environmental Information reported that there were 20 events in 2021, including Hurricane Ida, that were classified as billion-dollar natural disasters.

In many cases, small business owners are left scrambling to rebuild from the ground up, which can take months or even years depending on the severity of the disaster. Concerningly, 38 percent of employers affected by such disasters reported that they have been previously impacted by similar incidents, which may compound the financial strain these businesses face over time.

Even when a business is lucky enough not to suffer physical property damage, natural disasters can still result in loss of income for small businesses. Evacuations may force businesses to close, and losing customers and employees during an event can create significant financial burdens for businesses that rely on day-to-day cash flow to cover expenses like rent, payroll and utilities. Additionally, natural disasters can disrupt supply chains, even for businesses not in the path of a natural disaster. As was seen during the COVID-19 pandemic, supply chain issues can have long-lasting and profound effects on businesses of all sizes and the economy as a whole.

The importance of SBA disaster assistance

SBA disaster loans can be crucial in helping small businesses recover from natural disasters. While not all aid is created equal, research indicates that even small amounts of funding can help keep businesses afloat and mitigate disruptions in their cash flow. If this aid is dispersed quickly enough, companies will have time to apply for larger grants or assistance to cover repairs, replace lost inventory or replace equipment while still being able to cover their more immediate expenses, such as payroll. SBA loans provide low-interest, long-term financing that can bridge the gap, allowing small businesses to rebuild and reopen their doors. Without this aid, many companies would be forced to close permanently, leading to lost jobs and economic decline in affected communities.

States with the most natural disaster funding

As shown in the infographic, Louisiana, Hawaii, Alabama, Florida and Texas rank the highest for disaster relief funds available per small business. Several factors contribute to these states receiving more SBA disaster loan funding per small business, including:

- Location: States like Louisiana, Florida and Texas are located in areas prone to hurricanes. Alabama ranked second as the state with the most tornadoes in 2023, and Hawaii regularly faces tropical storms and wildfires.

- Frequency of disasters: Some states, such as Louisiana and Alabama, regularly experience natural disasters, meaning businesses in these areas are constantly recovering from the latest storm or event. This leads to a higher need for SBA loans.

- Small business density: California is one of the worst states for natural disasters, with frequent earthquakes and wildfires. However, it ranks only fourteenth in funds per small business despite receiving over $1 trillion in loans. Conversely, Alabama’s small number of businesses means more funding can go to each company. States like Florida and Texas have large numbers of small businesses, many of which are in industries like tourism that are heavily affected by natural disasters and, therefore, receive the highest amount of funding in the form of SBA loans among all states, which puts them higher in the ranking.

SBA loans and other financial aid are essential in helping small businesses recover from natural disasters. They offer the financial resources necessary for physical repairs and critical support for long-term survival and emotional well-being during the recovery process. However, with natural disasters becoming more frequent, businesses in these states need to prepare for such occurrences. Disaster preparedness plans, better infrastructure, and stronger state and federal government support can help companies recover faster and reduce the need for large amounts of SBA funding in the future.

And while recovering from a natural disaster can be worrisome, your business phone system doesn’t have to be. With Ooma’s communication solutions, you no longer rely on traditional copper-wire lines to connect with your employees and customers. Contact us today to learn more about all the different phone system features you can access with a reliable internet connection.

U.S. states ranked by SBA disaster funding per small business

State | Funds Allocated | Number of Small Businesses | Funds Per Small Business |

Louisiana | $2,038,645,695 | 464,681 | $4,387.19 |

Hawaii | $403,862,300 | 133,993 | $3,014.06 |

Alabama | $183,835,492 | 71,781 | $2,561.06 |

Florida | $4,293,011,977 | 3,132,192 | $1,370.61 |

Texas | $3,798,094,397 | 3,160,424 | $1,201.77 |

North Carolina | $414,972,200 | 1,008,881 | $411.32 |

Vermont | $31,073,700 | 76,878 | $404.19 |

Michigan | $325,990,976 | 908,007 | $359.02 |

Kentucky | $128,656,879 | 363,068 | $354.36 |

Mississippi | $86,470,448 | 266,385 | $324.61 |

Nebraska | $56,472,100 | 181,742 | $310.73 |

Iowa | $76,858,376 | 272,465 | $282.09 |

New Jersey | $255,697,082 | 952,029 | $268.58 |

California | $1,000,109,139 | 4,146,852 | $241.17 |

Alaska | $89,914,533 | 422,586 | $212.77 |

Rhode Island | $19,749,200 | 105,320 | $187.52 |

Oklahoma | $65,095,460 | 371,640 | $175.16 |

Oregon | $66,332,220 | 397,422 | $166.91 |

Colorado | $109,370,300 | 684,726 | $159.73 |

South Dakota | $13,343,000 | 89,679 | $148.79 |

Missouri | $76,050,032 | 548,647 | $138.61 |

South Carolina | $62,461,600 | 479,314 | $130.31 |

Tennessee | $80,465,600 | 664,681 | $121.06 |

Illinois | $142,591,615 | 1,257,064 | $113.43 |

Montana | $14,425,500 | 130,563 | $110.49 |

New York | $221,169,451 | 2,207,713 | $100.18 |

Arizona | $59,740,100 | 650,151 | $91.89 |

Georgia | $106,238,300 | 1,222,799 | $86.88 |

Maine | $12,409,400 | 149,493 | $83.01 |

New Mexico | $10,105,700 | 158,296 | $63.84 |

West Virginia | $6,646,150 | 109,300 | $60.81 |

Pennsylvania | $57,817,716 | 1,082,027 | $53.43 |

Connecticut | $15,437,400 | 354,013 | $43.61 |

Washington | $25,448,400 | 644,868 | $39.46 |

Indiana | $19,979,100 | 537,058 | $37.20 |

Ohio | $35,616,622 | 989,435 | $36.00 |

Wisconsin | $15,206,517 | 457,769 | $33.22 |

Utah | $2,325,900 | 333,661 | $6.97 |

Massachusetts | $1,387,800 | 697,585 | $1.99 |

Arkansas | $221,200 | 268,244 | $0.82 |

Virginia | $37,900 | 818,450 | $0.05 |

Minnesota | $24,300 | 525,156 | $0.05 |

Delaware | $0 | 98,356 | $0.00 |

Idaho | $0 | 188,603 | $0.00 |

Kansas | $0 | 256,287 | $0.00 |

Maryland | $0 | 639,789 | $0.00 |

Nevada | $0 | 312,702 | $0.00 |

New Hampshire | $0 | 136,506 | $0.00 |

North Dakota | $0 | 73,822 | $0.00 |

Wyoming | $0 | 73,330 | $0.00 |

Notes:

Delaware businesses were not eligible for U.S. Small Business Administration disaster loans until February 2023: https://www.sba.gov/article/2023/feb/09/sba-working-capital-disaster-loans-available-delaware-maryland-new-jersey-due-2022-drought-excessive

Idaho businesses were not eligible for U.S. Small Business Administration disaster loans until September 2024: https://www.sba.gov/article/2024/09/03/sba-economic-injury-disaster-loans-available-idaho-small-businesses

Kansas businesses were not eligible for U.S. Small Business Administration disaster loans until July 2024: https://www.sba.gov/article/2024/07/16/sba-economic-injury-disaster-loans-available-kansas-small-businesses

Maryland businesses were not eligible for U.S. Small Business Administration disaster loans until August 2024: https://www.sba.gov/article/2024/08/07/sba-disaster-loan-program-activated-maryland-drought

North Dakota businesses were not eligible for U.S. Small Business Administration disaster loans until October 2023: https://www.sba.gov/article/2023/10/04/sba-economic-injury-disaster-loans-available-north-dakota-small-businesses

New Hampshire businesses were not eligible for U.S. Small Business Administration disaster loans until July 2024: https://www.sba.gov/article/2024/07/11/sba-disaster-loans-available-nonprofit-organizations-new-hampshire-0

Nevada businesses were not eligible for U.S. Small Business Administration disaster loans until June 2023: https://www.sba.gov/article/2023/06/08/sba-economic-injury-disaster-loans-available-nevada-small-businesses

Wyoming businesses were not eligible for U.S. Small Business Administration disaster loans until September 2024: https://www.sba.gov/article/2024/09/10/sba-economic-injury-disaster-loans-available-wyoming-small-businesses

Sources:

U.S. Small Business Administration (https://www.sba.gov)

Federal Emergency Management Agency (https://www.fema.gov/emergency-managers/national-preparedness/frameworks/national-disaster-recovery/support-functions/rsflg/state-profiles)